Short answer: NEX Padel runs a controlled end-to-end OEM/ODM padel racket production1 workflow that balances MOQ2, lead time, and quality by combining flexible tooling, layered capacity planning, staged sample approvals, and multi-point quality control — enabling reliable bulk deliveries and repeatable customization for brands and distributors.

Why this matters to a procurement manager

- You need predictable lead times, clear cost drivers, and evidence of consistent quality before committing to large purchase orders.

- This guide explains how a supplier like NEX Padel organizes production planning, materials, tooling, QC, and shipping so you can compare suppliers on operational capabilities rather than marketing claims.

- The core production problem procurement teams face

- Uncertain lead times and hidden costs from tooling or rework.

- Inconsistent quality between sample and mass production.

- MOQ and cash flow constraints.

- Shipping delays that break go-to-market schedules.

Why these happen: misaligned sample-to-mass transfer, insufficient capacity planning, poor material traceability, and weak in-process inspection.

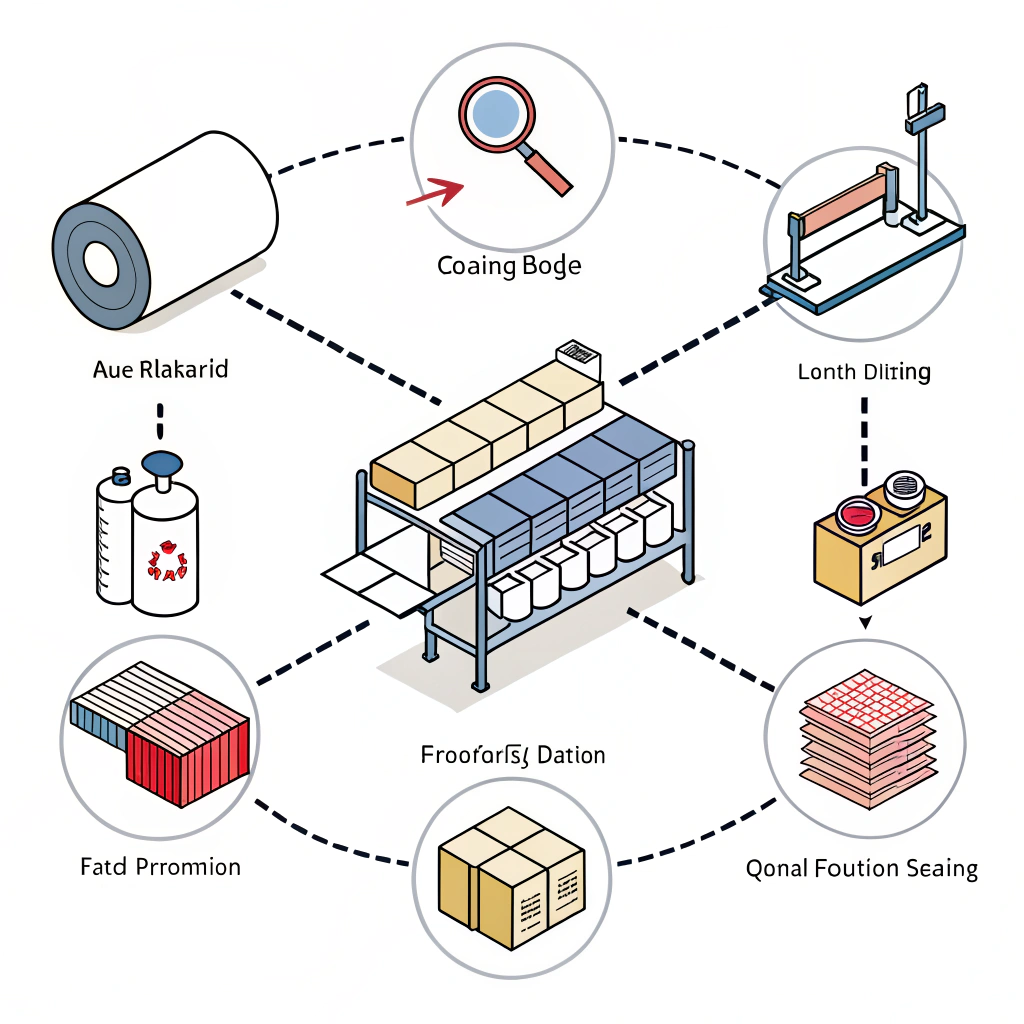

- How NEX Padel addresses the root causes (high-level workflow)

a) Forecast-driven capacity planning

- We size daily production by forecasting monthly orders and building buffer capacity. Typical single molding line throughput is in the low thousands per month (varies by design complexity); total output scales by adding parallel lines.

- Production scheduling uses weekly batches to reduce changeover time for custom prints and colors.

b) Material and layup control

- Core materials supported: fiberglass, and carbon fiber3 in 3k, 12k, 18k weaves. Each grade has documented supplier certificates and lot traceability.

- For each material lot we record: supplier, batch number, tensile spec, and layup orientation sheet — linked to the serials of rackets made from that lot.

c) Tooling and mold transfer

- Standard shapes (Diamond, Round, Teardrop) have reusable molds. Full-custom shapes require new tooling.

- Typical tooling policy:

- Standard-shape custom printing: MOQ 300–500 pieces.

- New-mold tooling: MOQ 500–1,000 pieces and tooling lead 10–20 working days depending on complexity.

- Tooling is validated with trial runs and first-article checks before mass production.

d) Sample and approval process (detailed timeline)

- Stage 0: Technical sign-off (3 days) — confirm specs, weight targets, logo files, colors (Pantone).

- Stage 1: Prototype sample (7–14 days) — one-off for fit and feel (handing sample).

- Stage 2: Pre-production sample (PPS) (7–10 days) — produced using production materials and same process; used for final approval.

- Stage 3: First Article Inspection (FAI)4 — run 2–5 units from the first batch for dimensional, weight, hardness, and surface checks.

Total sample-to-approval typical: 3–5 weeks (accelerated options available).

- Production quality control — checkpoints and standards

Key QC checkpoints: - Incoming Material Inspection (IMI) — verify certificates, visual checks, and incoming AQL5 sampling.

- Layup & Pre-Press Check — verify fiber orientation, core placement, and adhesive coverage.

- Curing & Demold Check — verify cure cycle and absence of delamination.

- Drilling / Edge Finish — dimensional accuracy and hole placement.

- Painting / Printing & Color Match — Delta E color measurement for critical branding colors.

- Final Assembly & Balancing — weight, balance point, grip assembly.

- Packaging & Random Functional Tests — play-feel sample and one destructive test per lot.

Recommended AQL and tolerances:

- Visual defects: AQL 2.5 for final goods (brands may request 1.5 for premium SKUs).

- Critical dimensions (weight ±5 g, balance point ±5 mm).

- Surface finish: no blistering, deep scratches, or paint runs.

What tests we run:

- Weight and balance measurement (digital scales and balance rig).

- Impact testing on sample units (benchmarks agreed at contract).

- Surface adhesion test for paint/print.

- Random drop/pressure tests for pressurized balls shipped with racket orders.

- Cost drivers and a sample cost breakdown

Major cost components:

- Materials (fiberglass vs carbon weave grade)

- Tooling and mold amortization (spread over MOQ)

- Labor and line efficiency

- Printing and color matching (multi-layer decals or UV printing)

- QC and testing

- Packaging and logistics

Sample cost table (illustrative structure; numbers are examples and vary by spec)

| Cost Item | Notes |

|---|---|

| Material | Fiberglass: lower cost; 3k/12k/18k carbon increases price progressively |

| Tooling (one-off) | Amortized over first production run (higher impact on small MOQ) |

| Labor & Overhead | Depends on automation level and local wage rates |

| Printing/Color | Complex multi-color jobs increase setup and inspection time |

| QC & Testing | Third-party inspection adds per-shipment cost |

| Packaging & Shipping | Includes tubes, boxes, container freight, duties |

Pricing tips:

- Move to higher MOQ to dilute tooling cost per unit.

- Simplify colorways to reduce changeover time and waste.

- Choose 3k or 12k carbon for balanced cost/performance; 18k is premium.

- Lead time and delivery strategies (practical options)

Typical lead time ranges:

- Prototype: 7–14 days.

- PPS to start of production after approval: 7–14 days.

- Production run (standard shapes): 30–45 days for 1–5k units; scale increases duration.

- Shipping (FOB China to EU/US): 20–40 days depending on mode (air vs sea) and port.

Recommended shipping strategies:

- JIT small batch shipments: split production into 2–3 batches for continuous replenishment; reduces inventory risk.

- Bulk sea shipment for cost efficiency with buffer stock at destination.

- Air for urgent replenishment (higher cost).

- Use mixed incoterms: FOB for standard orders; EXW with our freight consolidation if buyer prefers control.

Risk controls:

- Stagger production and ship in waves to avoid a single large delay.

- Maintain safety stock (1–2 production weeks) for best sellers.

- Arrange third-party inspection (PSI) before loading.

- Customization, printing, and color control

- Custom printing options: full-wrap UV print, hydro-dipping, heat transfer decals, or screen printing for grips.

- Color control: we use Pantone references and Delta E measurement; sample approval must include signed color confirmation.

- Branding on hand grips and end caps: custom molding and logo printing available; MOQ may apply.

- Packaging and ball options

- Rackets: individual boxes, shrink wrapping, and sometimes cardboard inserts for protection.

- Balls: supplied in pressurized tube packaging; choice of 45% wool or 57% wool mixes depending on play characteristics. Tubes protect pressure and extend shelf life.

- Combined SKUs: we can pack rackets with tubes in display cartons or ship balls separately to match retailer needs.

- Evidence and references that matter to procurement

- Traceable material certifications and lot numbers for every order.

- Sample sign-off documents: technical spec sheet, photos, and measurement reports.

- FAI report for first production batch.

- Packing list and pre-shipment inspection (PSI) photos and reports.

- Lead-time SLA included in contract with penalties for agreed milestones (negotiable).

Example client reference approach:

- Ask supplier for a recent FAI and PSI summary for a brand they serve (NEX Padel has experience producing for established brands such as Hirostar, Reebok, and Starvie).

- Request historical on-time delivery rate and percent defect rates to compare across suppliers.

- Practical checklist for your supplier evaluation

- Do they provide material certificates and lot traceability?

- Are tooling costs and MOQs transparent?

- Can they show a sample-to-production timeline and FAI reports?

- What are their in-process QC points and AQL levels?

- How do they manage capacity scaling and seasonal peaks?

- What shipping options and packaging specs do they offer?

- Do they accept third-party inspections and provide timely batch photos/reports?

Conclusion and recommended next steps

- For a first bulk order: agree PPS, set FAI acceptance criteria, split the first mass order into 2 shipments, and include clear penalties or remedies for major defects or late delivery.

- For continuous supply: negotiate quarterly forecasts, establish rolling production schedules, and include tooling amortization terms so unit price drops as volumes grow.

- If you value rapid sampling and flexibility in material choices (fiberglass up to 18k carbon), choose a manufacturer with documented material traceability and layered QC — which is exactly how NEX Padel structures manufacturing for brands.

People Also Ask

Q: How many padel rackets should you have?

A: For players the question is about personal use, but for procurement focus on SKU planning: hold enough stock to cover expected lead time plus safety stock. A practical rule is to maintain at least 4–8 weeks of inventory for fast-moving SKUs, and longer for seasonal peaks. For retail assortments, stocking multiple racket models (control, power, hybrid) improves conversion.

Q: Is 12K or 18K padel racquets better?

A: Neither is universally "better." 12K carbon often balances stiffness and cost, giving controlled power and good feel for many players. 18K carbon is denser and typically stiffer, favored by heavier hitters or premium lines. Choose based on your target player profile and price positioning; offer two tiers (12K mid-premium, 18K premium) to cover market segments.

Q: How big is the padel racket market?

A: The padel racket market is growing rapidly worldwide. Estimates project significant growth (double-digit CAGR over the next 5–7 years). For procurement, this means planning capacity and supplier relationships that can scale — negotiate flexible MOQs, expand tooling options, and ensure rapid sampling to capture seasonal demand spikes.

-

OEM/ODM padel racket production: Read to understand the operational differences between OEM and ODM models, what control points an end-to-end production workflow should include (IP, customization, validation), and how that affects lead times and supplier selection. ↩︎ ↩

-

MOQ: Learn how minimum order quantities are calculated, how tooling and amortization influence per-unit cost, and practical tactics (batching, amortization terms, staggered shipments) to reduce MOQ impact on cash flow. ↩︎ ↩

-

carbon fiber: The linked material explains carbon fiber grades and weave counts (3k/12k/18k), and how those choices affect racket stiffness, weight, durability, and cost—helpful for spec'ing product tiers. ↩︎ ↩

-

First Article Inspection (FAI): This resource shows what an FAI report should cover, how to set measurable acceptance criteria, and why FAI reduces discrepancies between samples and mass production. ↩︎ ↩

-

AQL: Learn about Acceptable Quality Limit sampling plans, how different AQL levels correspond to defect risk, and how to choose AQL thresholds for standard versus premium SKUs. ↩︎ ↩