Quick answer (for quick-scanning buyers)

To shortlist a reliable padel racket OEM in 2025, prioritize: (1) the materials you need (fiberglass vs 3K/12K/18K carbon1), (2) the core type and hardness (EVA / PE / foam2), (3) the manufacturing method (hand layup, RTM3, automated layup) and how each affects repeatability, cost and lead time, (4) proven quality control (impact / balance / weight tolerance) and (5) realistic prototyping-to-mass-production timelines (prototype 2–4 weeks, tooling 4–8 weeks, mass production 6–12 weeks depending on complexity). Expect trade-offs: higher-modulus carbon improves power and weight control but raises unit cost and tooling scrutiny; RTM and automation give consistent quality but require higher upfront tooling and MOQ4.

Why this matters now

Brand product managers and procurement leads face pressure to launch competitive padel lines fast. The sport’s rapid global growth makes getting material choices, cost-per-unit and delivery predictability right the first time critical. Your OEM selection determines whether your product roadmap hits performance, visual, and margin targets — or becomes a timeline and quality risk.

Key decision factors explained (shortlist checklist)

- Materials: fiber type and weave (fiberglass, 3K/12K/18K carbon), resin system.

- Core: EVA / PE / foam density and hardness options.

- Manufacturing process: hand layup, RTM (Resin Transfer Molding), automated layup, compression molding.

- Tooling & custom shapes: CNC tooling lead time, mold life, ability to support Diamond / Round / Teardrop custom shapes.

- Surface finish & printing: in-mold graphics vs post-print; color matching process.

- QC and testing: batch tests for weight, balance, impact resistance, seam/weld strength.

- Lead times & MOQs: prototyping, tooling, pilot runs, mass production.

- Sustainability & traceability: recycled fibers, low-VOC resins, energy/waste management.

- Value-add & logistics: custom grips, handles, branded packaging, pressed ball supply.

Materials deep dive: how fiber choice changes feel, cost and positioning

- Fiberglass: Lower cost, softer feel, higher vibration, typically preferred for entry-level and mid-range rackets. Easier to tune for comfort and control; less stiff than carbon. Good for lower price points and faster prototyping.

- 3K Carbon: Balanced weave for performance rackets—good stiffness-to-weight, responsive feel. Mid-high price point.

- 12K & 18K Carbon: Higher tow counts reduce surface texture and can increase stiffness and power. Often used where a premium aesthetic and higher stiffness are desired. 18K can be stiffer and more expensive; better for power-oriented rackets.

- Resin systems: Epoxy resins give better mechanical performance vs cheaper polyester resins; epoxy increases cost but improves durability and consistency.

Practical guide:

- If your target is entry-level volume with low ASP: fiberglass core layers + EVA standard core.

- If mid/high-end with emphasis on power and lighter weight: 3K/12K carbon face layers + higher-grade EVA or hybrid cores.

Core materials and playability (EVA / PE / foam)

- EVA: Long-established, offers predictable hardness and good energy return. Available in multiple hardnesses (soft/medium/hard) to tune control vs power.

- PE foam: Lighter, can improve feel and may shorten lifetime under heavy use, but useful for ultra-light designs.

- Dual-density cores (stiffer center, softer perimeter) let brands tune sweet spot and control without changing outer plies.

Design implication: Specify core durometer5 (hardness) and density as part of your tech pack; small changes in core mix change play characteristics dramatically.

Manufacturing methods — comparison matrix

| Method | Repeatability | Surface finish | Upfront tooling cost | Best for | Typical MOQ | Lead time (mass) |

|---|---|---|---|---|---|---|

| Hand layup + compression molding | Medium | Good (depends on sanding/paint) | Low-medium | Low MOQs, prototypes, bespoke looks | Low | 6–12 weeks |

| RTM / Resin Transfer Molding | High | Very good (consistent) | High | High-volume, consistent mechanical properties | Medium-high | 8–14 weeks |

| Automated layup (robotic placement) | Very high | Very consistent | Very high | Large-scale, tight tolerances | High | 8–16 weeks |

| In-mold / injection + co-molding | High | Excellent | High | Complex shapes, integrated graphics | Medium-high | 10–16 weeks |

Notes:

- RTM and automated layup reduce variability and scrap but require bigger tooling investments and higher minimum orders.

- Hand layup is flexible for rapid sampling and low-volume SKUs.

Surface finishing, printing and color matching

Options:

- In-mold graphics: durable, integrated; requires dedicated mold tooling and graphics plates.

- UV/solvent printing or pad printing post-mold: less upfront tooling, flexible color changes, slightly lower durability.

- Hydro-dipping: premium textured finishes but adds process complexity.

Practical advice:

- For seasonal color variants, prefer post-mold printing to avoid paying for multiple molds.

- For long-term hero SKUs, invest in in-mold graphics to achieve consistent premium finish.

Tooling, shapes and customization limits

- CNC tooling typically takes 2–6 weeks depending on complexity. Tool life depends on cycle frequency and material; high-volume molds may be hardened steel.

- Custom shapes (Diamond / Round / Teardrop / unique silhouettes) are standard. Full-shape customization increases tooling cost and prototype cycles.

- Logo on grips, removable handle caps, and custom packaging are commodity capabilities for mature OEMs.

Quality control and factory-proofed processes

Required QC checks to demand from suppliers:

- Dimensional tolerances (weight ±5 g, thickness at defined points)

- Balance point and swing weight tests

- Impact resistance and durability tests (accelerated aging)

- Adhesion testing for layers

- Visual inspection for finish, seam and paint defects

- Batch sampling and traceability (lot numbers, Raw material certificates)

NEX Padel practices (example):

- Pre-production material audit for carbon/fiberglass certificates.

- Statistical sampling in pilot runs, 100% weight & balance checks for premium SKUs.

- Third-party lab testing on request for impact and fatigue tests.

Sustainability and supply chain resilience

What matters:

- Recycled carbon and low-VOC resins reduce lifecycle impact but can affect mechanical properties and cost.

- Ask OEMs about energy use, waste management, and supplier traceability for fibers and resins.

- Multi-sourcing critical inputs (cores, grip tape, ball supplier) reduces single-factory risk.

NEX Padel notes:

- We source balls from a partner factory with controlled pressurized packaging and two wool-content options (45% and 57%). This reduces uncertainty for full kit deliveries.

Cost and lead-time trade-offs (practical bands)

Below are indicative, not firm, ranges for planning (USD per unit, excl. freight & duties):

- Entry-grade fiberglass racket (hand layup, standard EVA, painted): $8–$18

- Mid-range carbon mix (3K face, fiberglass back, standard EVA): $18–$40

- High-end carbon (12K/18K full carbon, premium epoxy, custom graphics): $40–$90+

- Tooling: simple mold $1k–$5k; premium steel molds $5k–$20k+

- Prototype: $200–$800 per sample depending on materials and finish

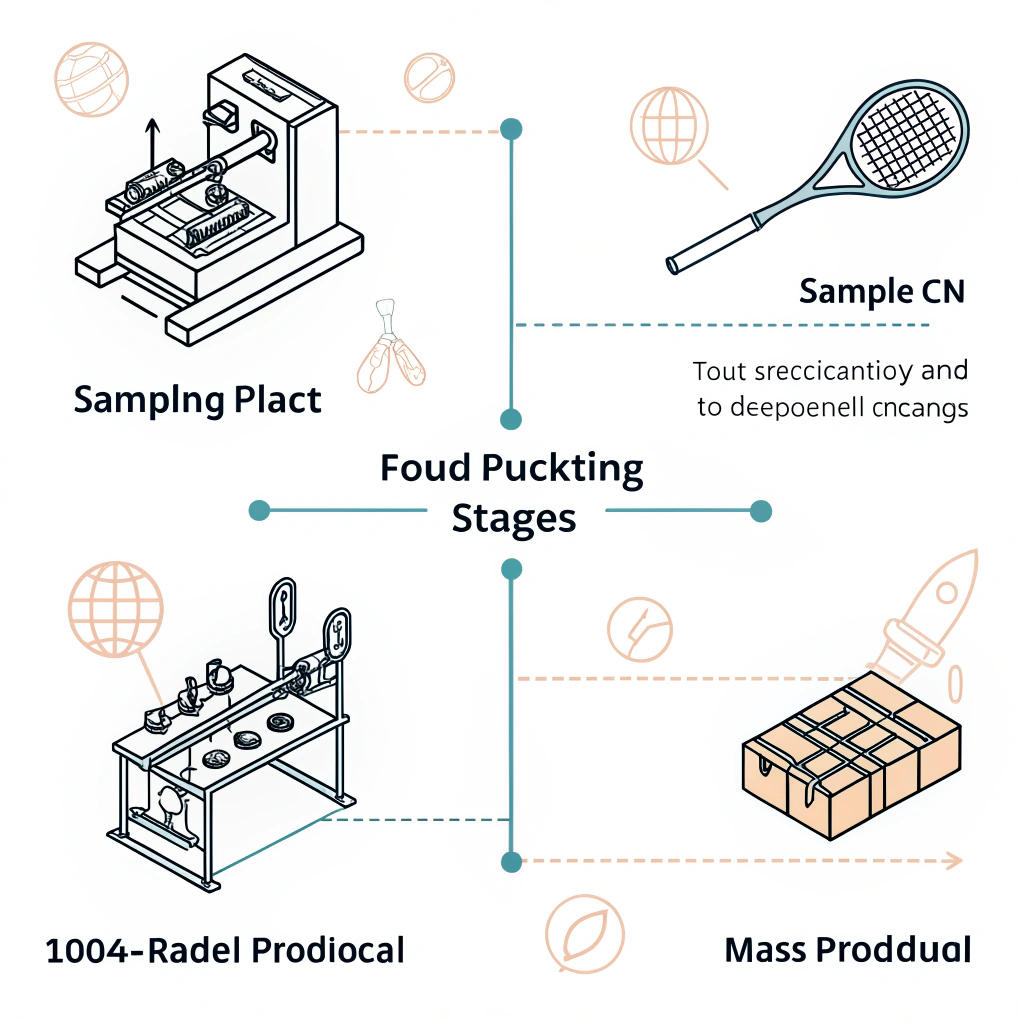

Timeline typical:

- Prototype + sampling: 2–4 weeks

- Tooling manufacture: 4–8 weeks

- Pilot batch (first production): 2–4 weeks after tooling

- Mass production: 6–12 weeks depending on volume and mold capacity

Checklist: Questions to ask prospective OEMs

- What fiber types and tow counts do you stock? (3K/12K/18K, fiberglass specs)

- What resin systems do you use (epoxy vs polyester)? Any low-VOC options?

- Describe your molding methods and the expected unit variance for weight and balance.

- What are your standard core options and durometers?

- Tooling lead times, mold life expectancy and costs?

- MOQ for RTM/automated lines vs hand-layup?

- Can you provide recent QC reports and references (brands you OEM for)?

- What's the process for color matching and graphic approvals?

- What sustainability certifications or measures do you have?

- What are your typical sample-to-mass-production timelines and penalty terms for late delivery?

Quick vendor scorecard (simple)

- Technical capabilities: carbon types, core options, molding methods

- QC rigor: testing, traceability, batch sampling

- Flexibility: custom shapes, printing, small runs

- Logistics: lead times, freight handling, buffer inventory

- Transparency: raw material certificates, factory audits

Short case examples and what they teach

- Brand A (mid-range line): Used 3K carbon face + fiberglass back with medium EVA core, hand layup for initial SKUs to test market. Result: quicker prototype-to-shelf, low upfront tooling. Lesson: hand-layup is ideal to validate product-market fit before committing to RTM tooling.

- Brand B (premium): Commissioned 12K carbon with epoxy, RTM for consistency and in-mold graphics. Higher margin per unit justified tooling cost due to long-term SKU plan. Lesson: RTM pays off when you have predictable demand and need consistent mechanical specs.

NEX Padel has executed both paths for OEM customers like Hirostar, Reebok and Starvie — meaning we can scale from low-MOQ prototyping to high-consistency RTM production.

Action plan for procurement leads (3-step)

- Define your play profile: target price band, feel (control/power/spin), expected annual volume, and graphic strategy.

- Run parallel sampling: one prototype via hand-layup (fast feedback) and one pilot RTM/automated sample (consistency check).

- Lock performance specs into the contract: weight tolerance, balance, impact test pass rates, defect rates, penalties for missed lead times.

Summary — what to require from suppliers on day one

- Clear material specs (fiber tow counts, resin type).

- Core durometer options and matching samples.

- Manufacturing method and MOQ for your volume projection.

- Tooling cost and expected mold life.

- Full QC plan and traceability.

- Prototype & pilot timeline commitments.

Choosing an OEM is about balancing performance, repeatability, cost and time-to-market. If you prioritize fast product validation, start with flexible hand-layup partners. If you need scale and consistency, insist on RTM or automation, accept higher tooling and MOQ, and lock in QC metrics.

People Also Ask

Q: Is padel growing faster than pickleball?

A: Globally, padel is expanding rapidly and in many regions (especially Europe, Latin America and parts of Asia) shows faster growth rates than pickleball. Pickleball has driven massive growth in North America, but padel’s international momentum — backed by strong club and infrastructure investment — makes it one of the fastest-growing racket sports worldwide.

Q: What is the most powerful padel racket 2025?

A: "Most powerful" is model-dependent and influenced by head shape, material layup and core hardness. Power-focused rackets typically combine high-modulus carbon faces (12K/18K), a stiffer core durometer and a diamond shape that shifts mass toward the head. Market winners in power share those design choices; specify those attributes when commissioning a power-oriented OEM model.

Q: What is the life span of a padel racket?

A: Lifespan depends on use and construction. For daily players, expect 4–6 months before the core shows significant wear. For casual players (2–3 times per week), a racket commonly lasts about a year. Higher-grade materials and construction (premium carbon, higher-quality resin systems) extend life; replacing the racket is often driven by core fatigue rather than cosmetic wear.

-

3K/12K/18K carbon: Read to understand how carbon tow counts (3K vs 12K vs 18K) change surface texture, stiffness, weight and cost — and which choices map to entry/mid/premium product positioning. ↩

-

EVA / PE / foam: Read to compare core materials (EVA vs PE foam vs other foams), their weight, energy return, durability and how core choices affect feel and lifetime for target player segments. ↩

-

RTM: Read to learn how Resin Transfer Molding works, why it yields consistent mechanical properties and finished surfaces, and when RTM justifies higher tooling and MOQ versus hand layup. ↩

-

MOQ: Read to clarify minimum order quantity expectations for different manufacturing methods (hand layup vs RTM vs automated) and how MOQs impact unit cost, inventory and launch strategy. ↩

-

durometer: Read to learn how core durometer (hardness) is measured and specified, and how small durometer shifts translate into playability changes (power vs control) and testing requirements. ↩